Exploring DeFi's Ownership Economy

How DeFi is finding product market fit with ownership incentives. Plus, a glimpse into tomorrow's highly anticipated MTA Genesis.

“Imagine if you could earn Amazon stock every time you used your Prime membership”

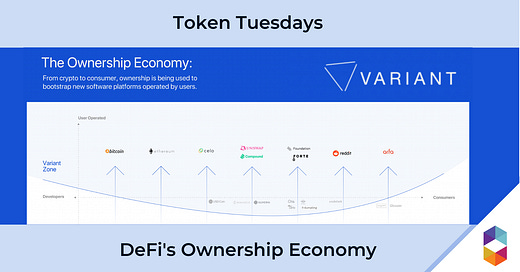

Now more than ever, that vision is slowly becoming a reality. Today, a former partner of a16z publicized a new venture called Variant - an early-stage fund focused on product-driven founders who understand how ownership can be a disruptive cornerstone of new products.

Underpinning his latest post - The Ownership Economy - is an in-depth analysis of how innovative companies took protocol innovations (like torrenting) and leveraged them to offer streamlined services (like Spotify) which were never before possible.

Likening tokens to packets of value, Variant theorizes that the most successful companies of tomorrow will be those that share their upside with their most value-added contributors.

“Rather than a platform’s inner circle of founders and investors taking home the value, users are able to earn the majority of value generated from their collective contributions.“

In this post, we’ll take a quick look at a select few projects doing this today, along with how these ideas are set to empower an entirely new wave of companies armed with a decade of finding tokenized product-market fit.

Note: You’re currently reading one of our free posts. To get content on the latest trends in crypto delivered right to your inbox every Tuesday, sign up for just $5/mo.

DeFi’s Ownership Economy

Over the past few months, we’ve talked extensively about projects giving ownership to their users. Whether this is a claim on protocol fees, the right to governance, or social capital through signal, perhaps DeFi’s most innovative feature is the ability for anyone to earn a voice.

The best part is that many of these new economic designs drastically favor early adopters, with native tokens earned through participation accruing value as the protocol grows.

The most obvious example of this is Synthetix - the sector-leading derivatives protocol offering SNX inflation to those minting sUSD or contributing liquidity to a number of incentive programs to stabilize its synthetic assets.

Outside of the die-hard following that emerges from those with an added financial incentive to see a project succeed, even products without tokens are enjoying the same network effects. As we’ve seen with Uniswap and it’s design to share it’s 0.3% protocol fees with liquidity providers, DeFi power users are now enjoying DEXs as the primary market for highly sought after projects to first kickstart token distributions.

When looking at Compound and Balancer’s newly popularized liquidity mining scheme, the premise of distributing tokens through protocol usage creates a powerful feedback cycle in which those who provide the most value capture the most upside.

But, here’s where the industry is currently reaching a roadblock.

Yield Farming Ownership for Profit

While ownership cycles like liquidity mining provide onramps for network effects, that doesn’t mean that all those new actors are amplifying the value of that ownership.

To provide a clear example, the meme of “yield farming” is entirely predicated around stacking alpha by earning governance tokens on top of attractive APYs.

What results is a system in which the vast majority of users are providing value simply to earn a return, rather than that value offering tangible benefits that keep those same actors engaged.

This “growth hack” is quickly sweeping the DeFi ecosystem by storm as projects like mStable have aggregated over $20M in TVL in under two months on the back of MTA yield farming incentives. (more on this below)

Everyone in DeFi knows that tomorrow’s MTA Balancer launch is sure to be the next hot token, and one that you’d be unwise to sleep on. But, what remains unclear is if the incentive to own mStable is actually valued beyond the return that comes with it.

Taking a step back, the premise of a community-owned and operated project is something that we’ve never seen operate successfully at full scale. It’s exciting to recognize that for the first time in history, value can be efficiently allocated across contributors in a permissionless, automated fashion.

What I hope to see emerge are more ways for tokens to be put to work, giving those who are most active in a given economy compounding returns over passive users or those who are only there to make a quick buck.

Liquidity provisions and work tokens are an obvious example, but I’m willing to bet there’s an entirely untapped playbook of ways to amplify power users through vested vehicles which propagate growth.

Wider Implications

When applying these premises to products which have nothing to do with financial primitives, it’s possible that new careers can emerge with them.

Using Audius’s distributed streaming platform as an example, curators will be financially incentivized to source the best content by receiving tangible value for playlists which aggregate the most traffic.

We can envision versions of Airbnb and Uber in which top hosts and drivers earn multipliers for their aggregate income or TikTok influencers collecting tangible value on the back of viral videos.

What’s important to remember is that the most powerful products of tomorrow will be owned by their users. We’re seeing it in DeFi today, and there’s no doubt in my mind this is the first of many sectors that will benefit from similar compounding returns in the future.

Next time we make a Token Pick, be sure to take note of its Ownership Economy, as this is one of the driving principles behind the top earners of 2020.

-------

mStable MTA Gensis

Still reading? You’ve just unlocked a sneak-peek into an extremely synthesized Token Pick. These are normally paid pieces, so consider this your lucky day!

**UPDATE: The MTA Genesis sale has been postponed and moved to Mesa. We will update this section with details on the raise tomorrow**

Tomorrow morning at 10AM EST, mStable will distribute it’s MTA governance token on Balancer.

mStable is a rising liquidity aggregator offering different mASSETS composed of same-peg tokens. Starting with stablecoins, mStable first launched mUSD - a USD pegged token backed by a basket of leading stablecoins like DAI, USDT, USDC, and TUSD. Users who mint mUSD can leverage the SAVE feature to earn attractive APYs (25% at the time of writing). Alternatively, they can risk it for the biscuit and provide liquidity to the mUSD/USDC Balancer pool to earn MTA inflation.

This tightly designed incentive has quickly led to the mUSD/USDC pool being the most liquid on the platform, with just over $21M of capital at the time of writing. Now, it’s second pool - mUSD/WETH - is not far behind at $9M of liquidity.

Given the latest theory around TVL being a direct correlation to token value, we expect tomorrow’s initial listing price of $0.15/MTA to see strong demand from DeFi power users. With only 2.8% of the circulating supply being liquid on the back of a $15M fully diluted market cap, it’s likely that yield farmers will race to get their hands on one of the few DeFi tokens whose market cap is lower than it’s current TVL.

Outside of governance rights, MTA will also bring about an EARN feature in which users can stake tokens to receive a claim on protocol fees in tandem with native inflation.

While it’s still extremely early for the project, their quick yet well-executed rollout is one to keep an eye on.

Disclaimer: Token Picks are not meant to be treated as investment advice. All opinions shared in this post are solely Fitzner Blockchain’s and should be valued as such. We encourage all of our readers to conduct their own research and recognize that investing in cryptocurrencies is an extremely risky asset class with inherent risk.

New ownership playbook is going to change:

a. The way capital is raised a.k.a liquidity

b. The way community is cohesive (through perpetual sharing of incentives - rev sharing)

c. The way governance is executed

d. The way profits/dividends are shared - collaborative growth

e. The way protocol/product is shielded

f. The way protocol/product becomes market fit - through active participation