Synthetix is a decentralized synthetic asset issuance protocol built on Ethereum. Formerly known as Havven, the project underwent a significant rebrand to expand their use-cases and future potential in November of 2018.

In essence, synthetic assets represent a combination of securities to simulate the price of a different underlying asset. As such, users can gain exposure to any supported derivative without ever having to maintain custody of the underlying asset itself. This allows users to quickly swap between abstract assets (say ETH to APPL shares) without experiencing any slippage, delays or exchange withdraw fees.

By using Mintr, synthetic assets called Synths are created by staking Synthetix Network Tokens (SNX) as collateral. Synthetix uses a private oracle to pull real-time information from credible financial market resources. As it stands today, the protocol currently supports synthetic fiat currencies, digital assets (long and short) and commodities.

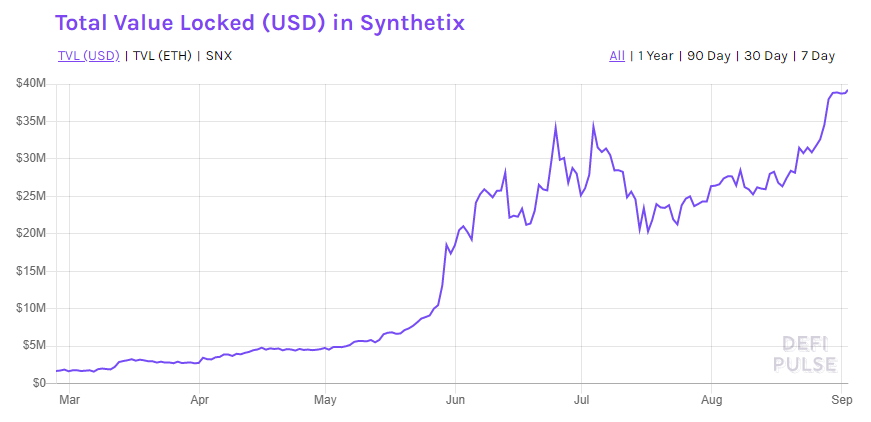

We believe Synthetix will play an important role in the proliferation of DeFi. By creating a generalized protocol to issue synthetic assets through collateralized SNX, developers and crypto investors can now gain access to a range of traditional and digital assets. Ultimately, SNX provides a framework to bridge DeFi and legacy finance derivatives. More importantly, since the recent changes in the monetary policy, the network has seen a substantial amount of growth in recent months. As it currently stands, Synthetix has 94.8M SNX (~70% of the total supply) locked in the system, up from 37.36M since March 2019. In dollar terms, Synthetix has reached nearly $40M in TVL as of September 2019.

Overview of SNX Token

SNX holders can lock their tokens as collateral to mint new synthetic assets (Synths), which track the prices of fiat currencies, commodities, stocks, and indices. Everytime a Synth is generated, a transaction fee of 0.3% is accumulated and ultimately distributed to holders with locked SNX in the form of sUSD (Synthetix’s native stablecoin). In the first year that Synthetix was live, only 300 users out of the 75,000 token holders were locking SNX into the system. While it still resulted in 40% of the total supply locked as collateral, the team realized that this small incentive was not large enough to spur widespread growth in the system.

Back in February, Synthetix announced that they will be implementing an inflationary monetary policy as an incentive to bootstrap network effects. Over the next five years, the total supply will increase from 100M to around 250M SNX with inflation diminishing over time. Below is the expected monetary policy for SNX.

In tandem with the other vesting schedules, the supply distribution should largely resemble this:

Token Distribution

At inception, Havven raised $250k in a seed round supplemented by a larger $30M ICO round priced at a reported base rate of $0.67/SNX. Lead by Synapse Capital, it’s safe to say that the company still has a decent runway in the coming year assuming funding was handled remotely well.

It’s worth noting that the token only broke it’s offering price for a short time during May of 2018, with recent activity indicating a new round of interest thanks to the new staking mechanisms listed above. As stated below, the large majority of the supply is currently being held in escrow for SNX staking.

Token Valuation

In order to properly value SNX, we must make a few assumptions surrounding the use of the network. These assumptions largely revolve around how much volume is traded through the Synthetix Exchange and how many stakers there are providing collateral to the system. This in turn estimates the amount of revenue the network generates during a given time.

Assumption 1: How much volume from Synthetix Exchanges

As it stands right now, the Synthetix Exchange experiences around $316,301 in 24-hour volume. With the total 24-hour market volume sitting at around $8 billion according to Messari, this translates to Synthetix capturing around 0.004% of the existing market. While synthetic assets have their place in traditional markets, it’s not a dominant asset class. With this in mind, we do not envision Synthetix capturing a significant majority in the exchange market due to the wavering demand of synthetic assets. However, we do want to note that these assets may be viable in bridging traditional assets to decentralized networks in the short term and could provide an intriguing opportunity for prospective investors.

Assumption 2: How much in fees will be generated

Given the above, we know that the Synthetix Exchange charges a flat fee of 0.3% for all transactions that occur on the network. With our exchange assumptions, we can easily estimate 24h network revenue.

Assumption 3: How many stakers of SNX

Earlier this year, the staking rate sat at around 40% of total SNX. With the new monetary policy, SNX saw a surge of new stakers on the network looking to claim the newly minted SNX coming into the ecosystem. This resulted in nearly 70% of SNX staked, according to DeFi Pulse. Over the next five years, we’re assuming that as the inflation rate continues to decrease, we will likely see a slight decrease in the overall percentage of SNX staked.

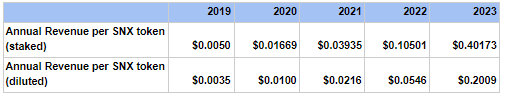

The total supply in tandem with the network revenue allows us to estimate the annual revenue per token. As seen below, we could assume that by the end of 2020, each SNX token will generate $0.01 in revenue if all SNX tokens are staked. Obviously this is unlikely to be the case, however, it does provide a good lower bound for our token valuation. The annual revenue per SNX token can ultimately be seen as outlined below:

DCF Model

The last aspect of our model is to assume a discount rate on the token. In typical venture capital and early stage investing, a discount rate between 30-50% is the norm for early stage startups. With this, we assign SNX a discount rate of 40% which ultimately allows us to use a DCF model to calculate the value of the token. The math can generally be seen as

PV = (Year 1 Cash Flow /1+r)^1+ (Year 2 Cash Flow /1+r)^2…+(Year n Cash Flow / 1+r)^n

Plugging in our numbers, we calculated that the value of SNX lies somewhere between $0.60-$1.20 depending on the dilution of the supply. With SNX currently trading at $0.43 and a market cap of $55M, this represents a +39.5% to +179% upside on SNX.

For a full breakdown of our assumptions, feel free to review our spreadsheet here.

Drawbacks/Concerns

While Synthetix has certainly made a strong case for a compelling token economy, we must recognize that there are a number of other competitors in the space looking to tackle similar problems. Most notably, Market Protocol and FOTA are the first projects that come to mind, each with slightly different variations on services offered and how their respective tokens play into their ecosystem.

From a more general perspective, the demand for blockchain-based synthetic assets will likely remain relatively niche for the foreseeable future. As it currently stands, the assets being represented on the platform are ones which are relatively easy to acquire through traditional mediums such as secondary exchanges like Binance. With this being said, now that the platform has found a strong foothold and established a solid foundation, it’s likely that new obscure niches will proliferate, allowing sophisticated traders to take unique positions that currently aren’t available anywhere on the market.

Lastly, SNX is currently only listed on a few niche secondary exchanges with less than $10k of active volume on the most popular trading pairs. While this may present a future upside upon listing on more reputable exchanges, please note that new investors may be subject to slippage due to order books being relatively thin.

Summary

Based on the strong amount of interest in network staking, active participants are likely in for a big year. By combining trading fees earned from Synth issuance with SNX staking rewards through inflation, early adopters of the platform have a unique opportunity to earn both income and increased exposure through active work on the platform. In the near future, the core team has announced expanded Synth sets including S&P 500 indices, DAI to sUSD conversions and open-sourced lending on protocols like Compound.

For an overview of how the network is fairing on any given day, the Synthetix Dashboard offers a clean breakdown of the various inner workings of the platform as a whole. Most notably, the dashboard cites that there is an active collateralization ratio of ~883% with 70% of all circulating SNX currently being staked. Similarly, all Synthetix Improvement Proposals can be followed here.

In conclusion, it would appear that Synthetix has found a recipe for success as one of the few platforms successfully able to encourage widestream staking amongst the most important network participants. As secondary markets continue to evolve, we’ll be keeping a close eye on Synthetix and the role synthetic assets will play in an increasingly diverse ecosystem.

Disclaimer:

Fitzner Blockchain employees currently hold no active position in SNX. With this being said, the company is long on SNX over the course of the next year and may take a position in the short-medium term. This report is not investment advice and we encourage all of our readers to do their own research and invest at their own risk.

Written By: Lucas Campbell and Cooper Turley