Two weeks ago we dove into the topic of participatory governance - or being the first to earn exclusive tokens by using rising Ethereum products.

As a quick recap, we’re seeing more projects follow the SAFG model where native tokens are distributed to users who perform value-added actions. However, unlike the ICO bounty models of 2017, these tokens hold no economic value, are non-transferable, and are purely used to govern the future of the protocol.

In this week's article, we’ll explore Balancer - a non-custodial asset management and liquidity protocol which recently launched its native governance token, BAL.

Just as with other governance tokens, the goal of BAL is for users to vote on major protocol decisions like new features, supported assets, and protocol fees. What’s more important is that with decentralized governance, the community can determine when tokens should have economic value - unlocking secondary liquidity when the time is right.

This model is drastically different from a core team being entirely responsible for listings, liquidity, and value accrual - especially when they already raised millions of dollars and have fewer incentives to ensure the token performs well in the wild.

We’re hopeful that this new distribution model will better align incentives between tokenholders and the core team, ultimately painting a model in which early adopters capture upside in the form of token appreciation as the protocol grows.

On Monday, Balancer started its Liquidity Mining program, granting users native governance tokens - BAL - for providing liquidity to the platform.

Here’s what you need to know.

What is Balancer?

Balancer is an AMM platform for programmable liquidity, where anyone can create and supply capital to a custom pool of ERC20 tokens. The protocol leverages Smart Order Routing to pull the best prices across all Pools, with each individual Pool receiving a Swap Fee whenever their liquidity is used.

These protocol fees are akin to DEXs like Uniswap where those who contribute capital receive a pro-rata share of the standardized 0.3% protocol fee.

However, the major difference with Balancer is two-fold:

Pool creators determine their own trading fee

Asset weights are freely customizable - rather than evenly split like Unsiwap.

The benefit of providing customizable weighing is that niche assets with little liquidity can go further by skewing Pools in favor of the target asset. For example, in the case of last week’s token pick - UMA, we’re seeing the top UMA pool skewed as 87% UMA, 13% WETH. Given the nascent nature of the rising DeFi token, this design mitigates slippage on larger orders by providing deeper liquidity in UMA relative to the base currency WETH.

What this means is that in the long term, we expect projects to leverage Balancer to bootstrap liquidity. As an end-user, this should result in lower slippage and more efficient markets.

Now, while we could talk at length about all the cool things you can do with Balancer Pools, let’s pivot to why you should provide liquidity.

BAL Liquidity Mining

Balancer is allocating 145,000 BAL per week to any user contributing at least two tokens to any Pool. This is set to distribute 7.5M BAL per year, up to the total amount of 75M (or 75% of the total supply) allotted to the Liquidity Mining Program. With 25M BAL allocated to the core team, we should see the circulating supply drastically favor liquidity providers in the coming years.

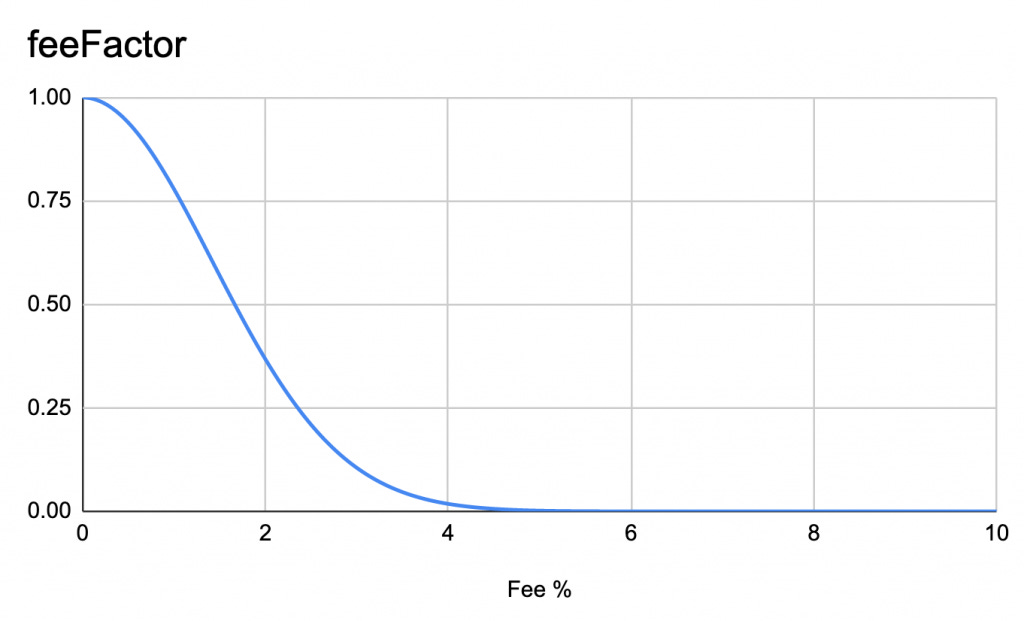

What’s most interesting about this model is the introduction of a feeFactor in which BAL issuance favors pools with lower Swap Fees. Stated another way, Balancer Pools which set lower trading fees are eligible to receive more governance tokens.

Lucas put it best when he said “This design makes pool creators (as well as liquidity providers) factor in whether they’d prefer to play the short-game of earning higher trading fees or play the long-game by minimizing trading fees to maximize their BAL earnings.”

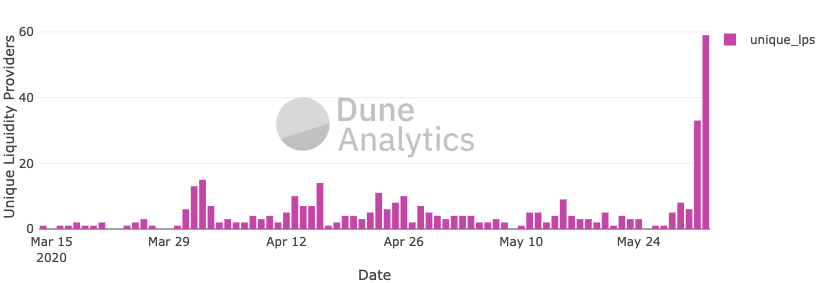

Since starting on Monday, Balancer Pools have seen a drastic spike across all metrics, best illustrated by the number of new liquidity providers entering the ecosystem. Big ups to the Dune Analytic king Matteo Leibowitz for these visuals.

Similarly, Balancer has been seeing a steady increase in LP revenue that - while still minuscule at just over $20,000 since launch - signals that more traders are starting to use Balancer, specifically for top pools like MKR <> WETH which suffer from limited trading pairs on centralized exchanges.

Key Takeaways

Should Balancer continue to grow, your best chance to earn BAL is now. Seeing as the amount of BAL allocated per week is fixed, you're best suited to earn a larger chunk of that pie today - regardless of the amount of capital you contribute.

While BAL currently holds no economic value, we’re very confident it will in the future - making you well suited to capitalize by providing liquidity, a form of usage which requires little to no sunk costs (you can take it out at any time).

In tandem with the release of Compound’s native token distribution, it pays (literally) to be a DeFi power user.

While it takes a little leg work to get started, being early to this trend is one you’re not going to want to miss.

If you or your project are looking to integrate Balancer into your protocol or are keen to spin up a Balancer Pool, give us a shout!

We’ve currently scheming on new ways (like 0% fee Pools) to farm BAL in the early stages of protocol growth and would love your input.

See you next Tuesday!