Introduction

When it comes to discussing the Decentralized Finance (DeFi) movement on Ethereum, it’s rare for MakerDAO not to be mentioned. As the current largest proponent of locked value according to DeFi Pulse, the platform has seen a substantial growth in usage over the course of the past year. At the time of writing, 1.4M ETH, or around 1.3% of the entire ether supply is currently locked in the MakerDAO system.

In short, Maker is a platform on Ethereum that enables anyone to leverage their digital assets to generate Dai stablecoins through Collateralized Debt Positions (CDPs).

Once generated, Dai can be used in the same manner as any other cryptocurrency: it can be freely sent to others, used as payments for goods and services, or held as long term savings. Most importantly, the generation of Dai in this manner creates the components needed for a robust decentralized lending platform.

What is Dai?

The Dai Stablecoin is a crypto-collateralized currency whose value is stable relative to the US Dollar. Anyone can obtain Dai by buying it from exchanges, and Dai holders can utilize a special mechanic known as the Dai Savings Rate to earn a steady, low-risk return on their holdings in the upcoming Multi Collateral Dai implementation.

How is this Done?

The process for generating Dai is pretty straight forward. In fact, Coinbase is currently hosting a tutorial to learn how to open your very own CDP here. Assuming you already hold ether ($ETH), users simply connect a Web 3.0 wallet such as Metamask or Ledger Nano S to the CDP portal.

After following a few simple steps and agreeing to the various parameters described below, Dai is autonomously minted and sent to your wallet through a smart contract without having any interaction with a third party. In particular, some of the parameters defined in a contract’s creation include:

Liquidation Price: The price at which your loan will be forced to liquidate, or “margin called”.

Liquidation Penalty: The mandatory fee that is paid if you are liquidated. Penalties are charged as a portion of existing collateral and are dynamically adjusted based on Maker governance decisions.

Collateralization Ratio: An indicator to see how leveraged your wallet is. It is recommended to maintain a ratio at least 50% above your forced liquidation to account for unexpected price swings.

Minimum Ratio: The ratio at which you will be force-liquidated, should your collateralization ratio fall below this ratio.

Stability Fee: A fee that needs to be paid in parallel with the DAI you borrowed to close your loan. As of writing, all stability fees must be paid in Maker’s native token ($MKR) or Dai ($DAI), with the expectation that these fees will be able to be paid in additional tokens in the future.

MKR Token

In single collateral Dai, the MKR token is primarily used for two things, stability fees and governance.

Users who open a CDP accrue interest through a stability fee. This fee can only be paid in MKR or DAI. Paid fees are ultimately burned and taken out of supply permanently, creating a steady force to increase scarcity of MKR as the amount of open CDPs increase.

Secondly, MKR holders have the privilege of participating in governance decisions over multiple aspects of the system. In single collateral Dai, MKR holders determine the stability fee. In multi-collateral dai (MCD), governing rights will expand into deciding which assets can be used as collateral in CDPs. On August 12th, the Maker ecosystem began polling MKR holders to signal their interest on which assets should be added in MCD.

On August 19th, the polling for asset listing in multi-collateral Dai ended. The results are as follows:

You can view all active proposals and polling here: https://vote.makerdao.com/

How is Maker Used Today?

Users opening a CDP through Maker generally do so to gain leverage. Users can collateralize ETH, generate Dai, and then purchase additional ETH with their newly minted Dai, resulting in the user having leveraged exposure to ETH. Since the debt is measured in Dai, if the price of ETH goes up, users can pay off their outstanding debt with less ETH, then hold onto the remaining ETH once the CDP is closed.

In July, Coinbase Earn expanded on their Dai stablecoin tutorial (mentioned above) by allowing users to earn an additional $14 in Dai by opening a Maker CDP. This resulted in an explosion in open CDPs, skyrocketing with 1720% growth month over month and nearly passing 75,000 open CDPs in recent weeks.

Token Statistics

Token Sale & Distribution

In December 2017, Maker sold $12 million MKR in a private round to a group of investors led by Andreessen Horowitz and Polychain capital in addition to receiving investments from Distributed Capital Partners, 1Confirmation, FBG Capital, Placeholder VC, Wyre Capital and others. A year later, in December 2018, Maker announced that Andreesen Horowitz had purchased an additional $15M in MKR.

Source: https://messari.io/asset/maker#profile

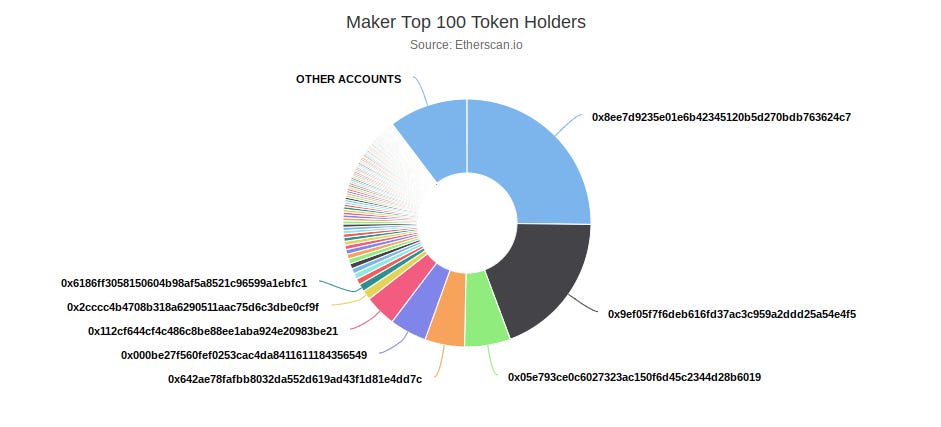

Even with the limited investors in the private sale, MKR still bolsters nearly 14,000 addresses holding the token. However, according to Etherscan, the top 100 holders control 89.71% of the supply including exchange wallets.

By subtracting the Maker Foundation’s ~250,000 MKR, the distribution shifts to the top 100 addresses controlling around 64% of the supply.

MKR Scarcity

As it stands today, only 3,828 MKR (0.382% of MKR supply) has been burned through the closing of CDPs. However, with the explosion in interest in Dai through the rise of DeFi and Coinbase Earn, the amount of MKR accruing through stability fees is growing rapidly.

If all CDPs continued to stay open for the next 12 months, the estimated annual burn rate would reach 31,871 MKR (3.187% of supply). On the other hand, if all open CDPs closed today, we would see nearly 7,182 MKR being burnt (.7182%).

It goes without saying that MKR is a rather scarce asset. We can assume that over the next few years, with the continued growth in DeFi, that Dai will continue to gain popularity throughout the ecosystem. With that in mind, we can only expect that the burn rate of MKR over the next few years will continue to increase as the industry explores new use cases for Dai and DeFi on top of the release of MCD and a potential raise in the debt ceiling.

Future Benefits

As it currently stands, MCD proposes a solid foundation for increased MKR governance. Furthermore, the introduction of the Dai Savings Rate (DSR) will further incentivize owners to hold their Dai.

A person who holds Dai can lock and unlock Dai into a DSR contract at any time. Once locked into the DSR contract, Dai continuously accrues, based on a global system variable called the DSR. There are no restrictions or fees for using DSR other than the gas required for locking and unlocking.

The DSR implementation should create a strong cycle for more MKR to burned when larger stability fees are ultimately paid. In short, we expect MKR burning to increase substantially through the introduction of MCD.

Drawbacks

While many things are looking great for MakerDAO’s future, it is worth noting that at this point in time, MKR is listed on very few reputable secondary exchanges. As such, liquidity spreads are often very wide, with daily volume often being very low.

Furthermore, governance participation has generally ranged from 2-5% of the total supply averaging less than 50 unique votes per decision, a common occurrence for blockchain ecosystems at large.

While Maker’s governance system may be more active than most other projects, this limited range of engagement shows that only a minor percentage MKR holders are using the token for one of it’s core use-cases.

Summary

In closing, we believe that Maker is in for a strong year as we approach Ethereum 2.0. With the continued growth of the DeFi ecosystem, Dai continues to play a crucial role in the functionality and opportunities many of these platforms provide.

https://twitter.com/sassal0x/status/1162074479100485633?s=20

For those interested in staying up to date with the latest news and information surrounding the platform, weekly governance calls are hosted every Thursday at 12PM EST. Links to the calls can be found via the Maker Telegram with summaries being uploaded to the official YouTube channel within 48 hours.

For more information on the strongest token economies in the blockchain ecosystem, be sure to stay subscribed for a weekly edition of Token Tuesdays presented by Fitzner Blockchain Consulting. You can stay up to date with us via the following social channels below. Until next Tuesday!

Official Fitzner Social Accounts: Twitter, LinkedIn, Facebook, Instagram

Website: http://fitznerblockchain.consulting/

Written By: Cooper Turley (https://twitter.com/Cooopahtroopa)

Lucas Campbell (https://twitter.com/0x_Lucas)

Disclaimer

Token Tuesdays are not meant to be taken as financial advice. Fitzner Blockchain Consulting The content below references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice. We encourage all of our readers to conduct their own research and invest at their own risk.