The Case for BNT in Bancor V2

Learn more about why Bancor V2 is set to shake up the DEX landscape and drive value back to BNT in our latest Token Pick.

DeFi DEX’s are all the rage. Whether it’s Uniswap, Balancer, or the other niche markets popping up across the board, there’s no denying that the best place to get the hottest token on the block is through a permissionless Automated Market Maker (AMM).

Weekly DEX volume in 2020

What’s unique about the aforementioned DEXs is that price is established automatically by trading against an open liquidity pool using a predetermined curve. This means that regardless of how much (or how little) liquidity there is, traders will always be able to interact with the market so long as there is capital present. Here’s a great deep dive on AMM’s for anyone looking to learn more.

For people providing liquidity, we’re now seeing compounding returns not only from trading fees, but from liquidity mining in the case of BAL, CRV and dozens of others sure to pop up in the near future.

But, as anyone who’s actually participated in these liquidity pools knows, impermanent loss is a real bitch.

In essence, if you’re providing liquidity to a Uniswap or Balancer pool and that token moons (like virtually every DeFi token in the past 3 months), you essentially lose a portion of your holdings as the AMM rebalances the weighting to an even 50/50 split. Even with liquidity mining present, it’s become obvious that the value to be realized from simply holding the token almost always outperforms being present in a liquidity pool (even with the incentives on top).

While Balance’s adjustable weights help with this to a degree (think 80/20 splits), the underlying principle is that “useful” liquidity almost always comes in the form of 50/50 weighting. But, with 50/50 weighting comes a higher degree of impermanent loss.

So - what’s the solution?

In this week’s Token Pick, we’ll be diving into Bancor V2 - a forthcoming upgrade to the Bancor protocol which looks to almost entirely eliminate impermanent loss through a unique dynamic AMM design.

Outside of the protocol design, we believe the value capture mechanism for BNT will drastically increase through the advent of staking and the BancorDAO shortly thereafter

Let’s dive in.

Note: You’re reading a sneak peek of our paid Token Picks. For just $5/mo you can have reports like this delivered right to your inbox each and every Tuesday!

What is Bancor?

Bancor was one of the first DEXs built on Ethereum. Made famous for their $150M ICO in 2017, Bancor has long had somewhat of a weird standing in the wider Etheruem community. While the product works, it’s requirement to hold BNT as a means of providing liquidity drastically hindered its adoption relative to competitors like Uniswap and Kyber which largely rely on ETH.

In essence, every trading pair uses BNT as a reserve. This design allows any two tokens to be connected in a trade but created somewhat of a bottleneck for people to actually provide liquidity, thus reducing the desire for traders to use it. For more context on Bancor’s V1 design, check out this resource.

Bancor V2

Now, Bancor is gearing up to make the case for LPs much stronger through the launch of their V2 upgrade featuring:

A dynamic AMM that mitigates impermanent loss

The ability to provide liquidity with 100% exposure to a single token

A more efficient bonding curve to reduce slippage and

Support for DeFi lending protocols

The key thing to keep in mind here is that Bancor V2 will offer a brand new form of providing liquidity that is arguably the most capital rewarding for any DEX in the wider Ethereum ecosystem.

Taking liquidity mining out of the equation, the lack of impermanent loss paired with the opportunity for passive returns from lending protocols creates a very strong dynamic for traders to put any token to work (and not need to worry about losing some of that position from impermanent loss).

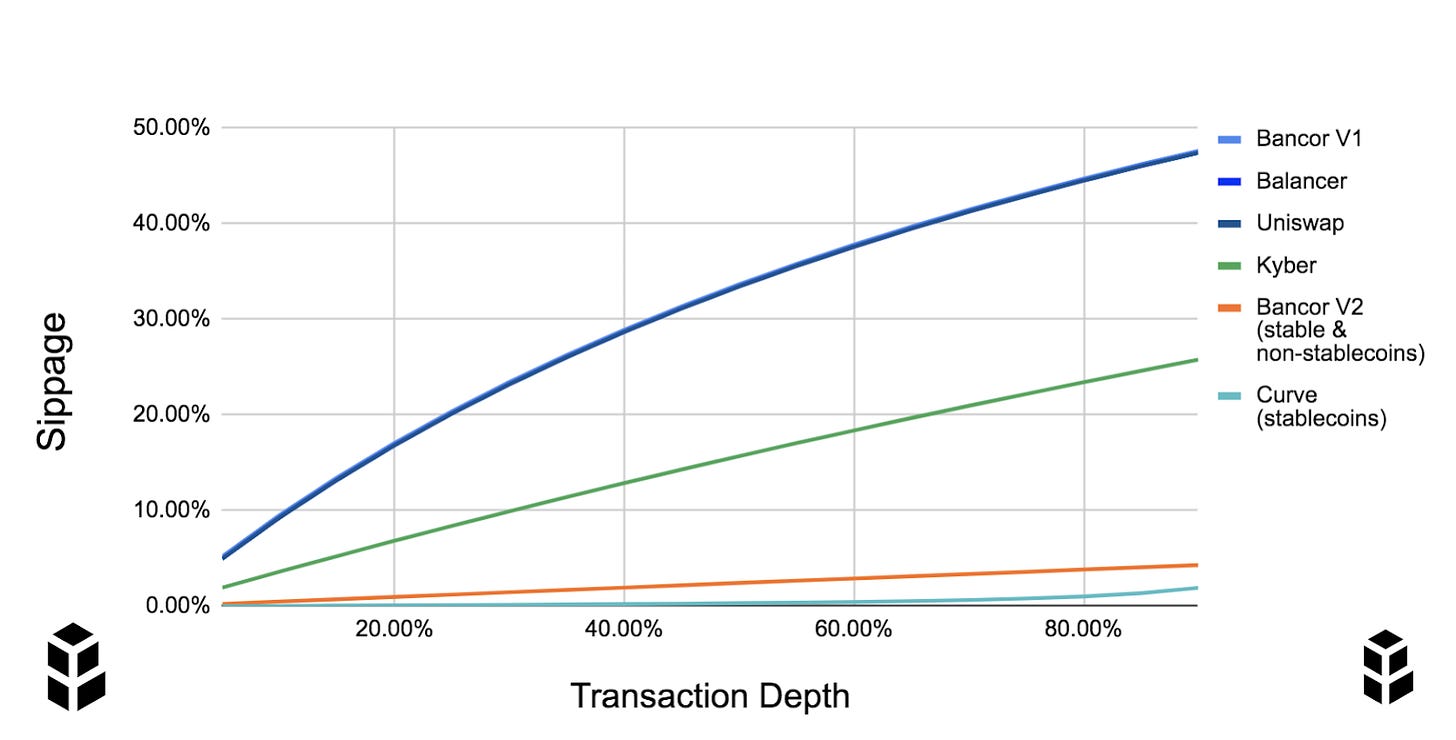

On top of this, Bancor V2 is designed in such a way that slippage is drastically limited for both stable and non-stable tokens.

Bancor states that a $101K pool would offer better rates than a $2M pool on Uniswap. Here’s an excellent illustration of what this looks like.

High capital efficiency allows Bancor pools to capture volume and drive higher fees (APR) for liquidity providers. For the end-users, this means Bancor pools can offer better prices than other DEXs using less liquidity.

To do this, Bancor V2 utilizes a new type of liquidity pool which features:

Single-Reserve Pool Tokens: Each v2 pool is anchored to two pool tokens (one per reserve)

Staked Balance and Current Balance: For each reserve, staked balance indicates the total amount of tokens staked by liquidity providers, and current balance indicates the amount of tokens held in the reserve.

Dynamic Weights: The pool updates reserve weights to incentivize market participants to equalize the current balance with the staked balance.

Price Feeds: Price feeds are used for calculating the weights such that after arbitrage closure, the pool price becomes equal to the market price.

For the sake of length, the key takeaway here is that you can enter a Bancor V2 pool with any token you want, and be sure that regardless of how the price changes, you’ll be able to exit with that same amount of tokens.

Now, assuming this catches on, Bancor V2 will likely see a drastic increase in both native volume and attention from DEX aggregators like 1inch.

This in tandem with the upswing in Bancor V1 annualized earnings and… we’ve got rocket-fuel.

The Case for BNT

Now, in order to aggregate that liquidity, Bancor will need to compete with the likes of Balancer and their BAL liquidity mining.

To this, we’re excited to watch how BNT staking plays a role. In essence, LPs contributing to Bancor V2 pools will stand to earn staking rewards in a Compound-esque fashion.

What this means is that staking to the pools generating the most trading fees will earn you the most BNT inflation.

“The Bancor Protocol will start generating staking rewards through the creation of new BNT (inflation). To begin earning rewards, you must deposit BNT into a Bancor liquidity pool (e.g., the MKR/BNT pool). Holding BNT in a Bancor pool entitles you to a share of its staking rewards.”

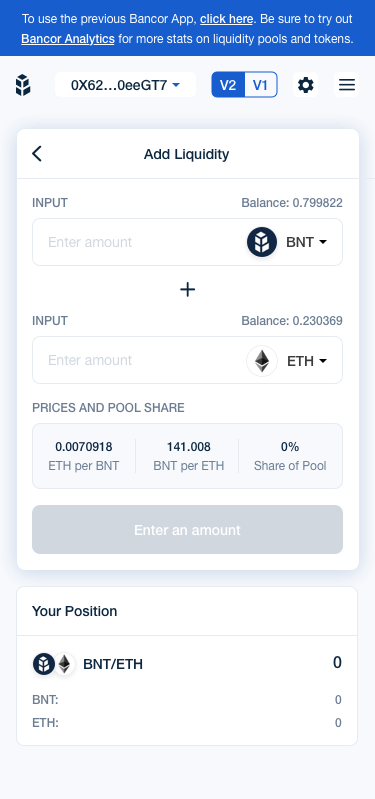

Here’s a look at what this may look like on any given day.

Now, tie this together with trading fees and no impermanent loss and we’ve got more or less one of the strongest LP tokenomic models to date. But, the party doesn't stop there.

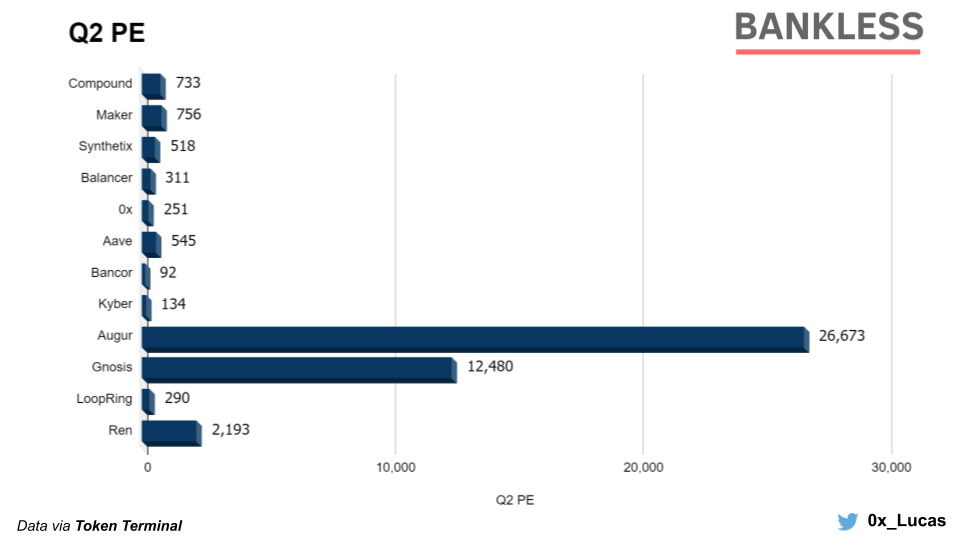

At its current value of under $1.50 at the time of writing, BNT is trading at a P/E ratio of just 29.9 according to Token Terminal. This gives BNT the lowest P/E of any DEX token on the market. (Remember low P/E means more room for future growth)

Come Bancor V2, we expect volume to increase significantly. Given that BNT is the intermediary token within every pool on Bancor, as token price rises, pools become more liquid and attract more volume and fees (i.e. "earnings").

Shortly after the launch of V2, the BancorDAO will allow BNT holders to not only vote on staking rewards but also change value accrual. Just as we’re now seeing with KNC and KyberDAO, we fully expect that BNT holders will look to allocate a portion of trading fees to the DAO - and thus to BNT itself.

Game On

While BNT has already seen a very strong run-up in 2020, it’s circulating valuation of $96M paired with its fully diluted valuation of $102M makes it one of the most well-distributed tokens on the market. This is in stark contrast to the existing DeFi token models in which a minuscule amount of the supply is circulating relative to the total.

While this may not make for as strong immediate rocket fuel, we believe BNT represents a sound pick that is likely to benefit from the success of Bancor V2.

If nothing else, it will be interesting to see if Bancor can solidify itself as a major liquidity provider in the ever-evolving, rapidly growing DEX landscape.

Until then, be sure to keep an eye on the project on Twitter for more news about Bancor V2, staking rewards and the BancorDAO!

Like this post? Give it some love!

Disclaimer: Fitzner Blockchain is long BNT. This content should not be treated as investment advice and we strongly recommend that all our readers do their own research before making any decisions. Never invest more than you are willing to use and keep in mind that cryptocurrency trading is extremely volatile.

Great description! You inspired me ;-) Thank you!