PoolTogether is Mooning!

Outlining the recent growth in PoolTogether and future improvements ahead.

With the advent of passive income opportunities using DeFi products, it's no surprise that stablecoins like Dai have seen steady supply growth in the past quarter.

The DeFi lending market is led by projects like Maker and Compound, both of which offer noncustodial solutions to earn interest on supplied assets. As we continue to explore the notion of composability - or products integrating and using solutions from other projects - we’re starting to see some truly novel use-cases emerge.

In today’s article, we’ll be taking a look at PoolTogether - the world’s first no-loss lottery.

PoolTogether pools stablecoins like Dai to leverage lending opportunities and collect interest for a prize pool. For every dollar contributed, a user receives one lottery ticket. The interest collected from the entirety of the pool’s capital is then awarded to one lucky ticket holder each week.

PoolTogether is non-custodial, meaning users can redeem their tickets from the pool at any time. The value of stablecoins always remains the same, meaning these raffles are truly “no loss lotteries”. Tickets are recycled week after week, meaning once capital has been deposited, users are eligible to win every week until they exit the pool.

Let’s take a look at some other notions that make PoolTogether “valuable”:

We’ve seen numerous parties “sponsor” PoolTogether, meaning their funds collect interest, without being eligible to win the drawing.

PoolTogether leverages a Uniswap front-end integration, a notion we’ve been very passionate about recommending for Ethereum products across the board.

The PoolTogether team recently announced their intentions for new features, all of which should gradually increase adoption of the product at large. (described in our conclusion)

In summary, PoolTogether allows users to *possibly* earn larger rewards than they would be able to on their own in an intuitive, exciting fashion. To give a clear example, it would take 11.2 years to earn the same amount of interest on 1000 DAI collecting the Dai Savings Rate for the same reward of this week’s prize (~$672).

Let’s take a look at how PoolTogether has grown in recent months!

Historical Growth

Since the inaugural prize pool back in September 2019, PoolTogether has seen fairly consistent growth week after week. DeFi users continue to contribute funds towards the pool, looking to capitalize on the growing prizes for essentially zero cost.

The graph below outlines total committed deposits from community members while omitting sponsored Dai contributions. The pool was originally seeded with $150,000 in sponsored Dai back in late December upon the introduction of MCD.

Towards the end of 2019, PoolTogether made the transition to support Multi-Collateral Dai (DAI) for its no loss lottery. Since then, it should come as no surprise that Sai has seen a decrease in usage as users continue to adopt the newer, sleeker version of MakerDAO’s trustless stablecoin.

Taking a more granular look at growth since the introduction of MCD, the prize has grown to an estimated $671 for the pool ending on January 24th, increasing by +454.55% in a matter of a few weeks. The recent surge in PoolTogether’s growth may largely be attributed to the addition of sponsored Dai, essentially boosting the weekly prize pool and creating an increased incentive for prospective users to join the pool.

Over time, it will be interesting to see how sponsored Dai continues to play a role in the growth of the pool and how that additional incentive drives traction from the broader community.

This Week’s Drawing

The current prize pool for January 24th, 2020 is by far the largest in PoolTogether’s history. Nearly $500,000 is currently pooled by community members with another $132,000 from sponsored Dai, representing an estimated prize of $672 for one lucky winner.

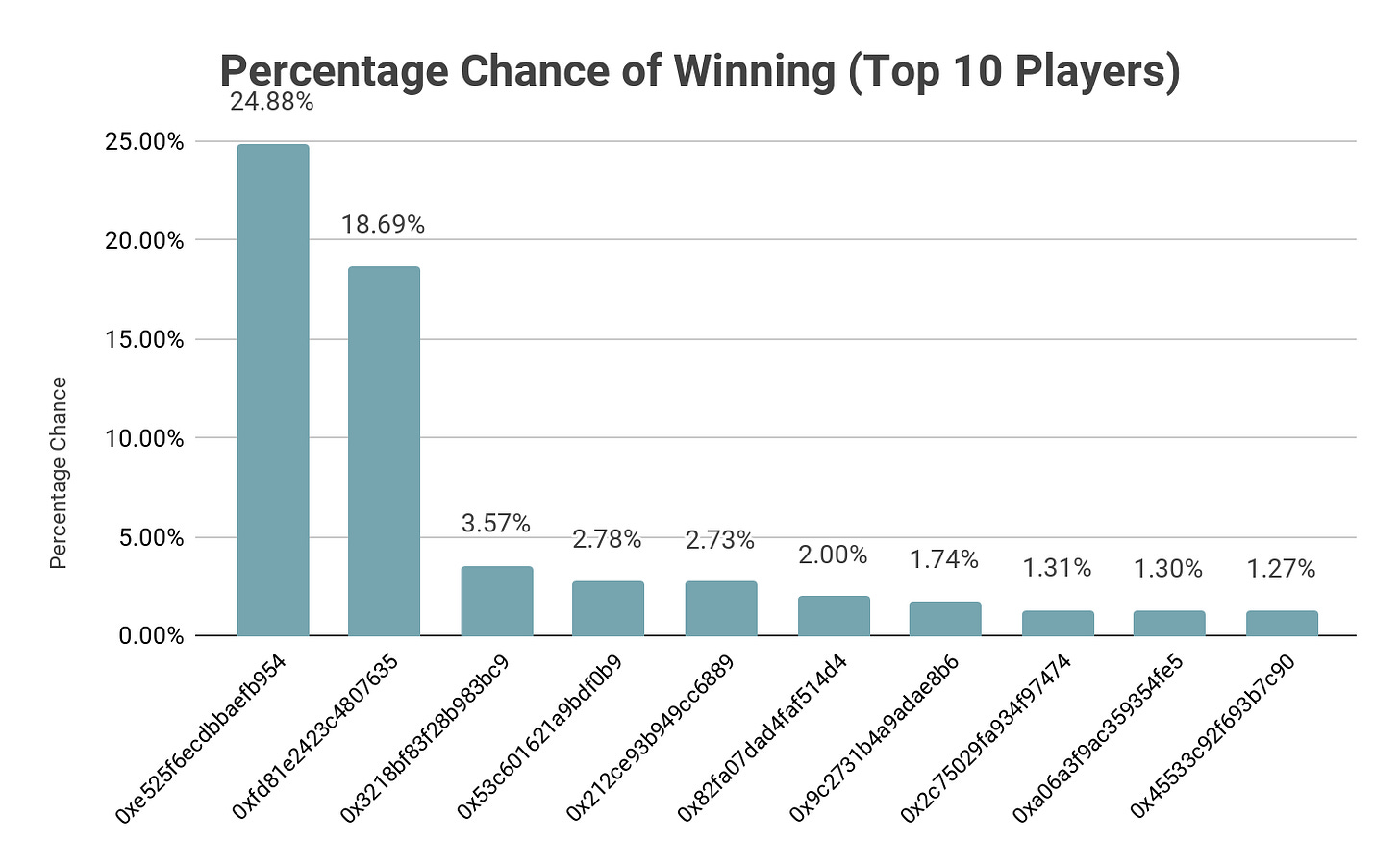

With that, there are currently 1,253 addresses all hoping to win this week’s pot featuring two major whales. Each of the two major addresses have a 24.88% and 18.69% chance of winning with the next biggest player only having a 3.57% chance.

As of writing, contributing 1 DAI will give you a ~0.0002% chance of winning the lottery pool.

While whales currently dominate the chances of winning the prize pool, there’s a handful of new features and improvements in the pipeline to help mitigate the control these whales may have over the system.

New Features

Additional Stablecoin Support

PoolTogether will soon incorporate prize pools for assets other than DAI including stablecoins like US Dollar Coin (USDC). USDC currently has 4x the market size of DAI, indicating there is a large opportunity for more capital to flow into PoolTogether pools. Similarly, USDC lending rates have been steadily rising, meaning more interest can be collected for prizes.

PoolTogether Pods

One of the few downsides to PoolTogether is that without significant capital, your chances at winning are fairly low. Pods would aid in this notion by allowing small groups to pool their tickets together, effectively increasing their chances at winning. In the event that a given Pod ticket were to win, the prize would be split pro-rate among all the Pod participants.

New Wallet Support

While PoolTogether supports most of the major Ethereum wallets (MetaMask, WalletConnect, Portis, Coinbase Wallet and Squarelink), it’s likely that additional wallet support opens new avenues for more pool participation. Similar to what we’re seeing with Multi-Collateral Dai’s integration with secondary exchanges like OKEx, it’s possible (custodian issues aside) that PoolTogether’s contracts *could* be leveraged by larger funds to further increase pool capacity.

Looking Forward

All in all, it’s evident that what was started as a specialized product has gradually evolved into a compelling experiment relevant to lotteries at large.

As we continue to see more uses for stablecoins and passive income opportunities, we expect products like PoolTogether to play a large role in the gamification and “coolness” or blockchain-based systems at large.

In the meantime, be sure to stay up to date with PoolTogether via their official Twitter.

If you or your company are interested in learning more about PoolTogether and how to integrate their contracts into your product, give us a shout!

See you next Tuesday!