Blockstack: A New Decentralized Computing Network

An analysis on Ethereum's competitor, Blockstack and the STX token.

Introduction

In the past three years, the blockchain ecosystem has seen tumultuous growth in new layer one infrastructure coming to the table. In short, virtually all of these solutions leverage distributed computing in an attempt to garner a vibrant ecosystem of web 3 applications. Most of these projects offered slightly different twists on how consensus is achieved, ultimately hoping to be the first protocol that brings blockchain technology to the masses. More importantly, infrastructure became a dominant investment trend in 2017 due in large part to the fat protocol thesis.

In this week’s article, we’ll be taking a look at Blockstack, a decentralized computing platform fueled by STX tokens built with the mission to enable fair and open systems that allow users to control their own data.

The reason we’ve chosen to cover Blockstack is that they are the first token project to receive approval from the SEC for a Reg A+ token offering. For those unfamiliar with why this is important, this security exemption allows Blockstack to compliantly raise funding from unaccredited US investors through a utility token, a first in the industry to date.

With this in mind, we believe that Blockstack has set a strong foundation for long-term growth. The Blockstack ecosystem currently consists of over 250+ applications, making it one of the few blockchains to compete with Ethereum in terms of the sheer quantity of development activity.

Without going into too much technical detail, Blockstack was designed to focus on ease of use, scalability and user control. The computing network can largely be broken down into the following components:

Stacks Blockchain: The foundation for the Blockstack network that enables users to register and control digital assets and smart contracts.

Gaia: A native decentralized storage system that enables applications to interact with private data lockers (i.e. private applications).

Blockstack Authentication: An authentication protocol for decentralized authentication that enables universal logins.

Blockstack Libraries & SDKs: A suite of developer libraries and SDKs that allow developers to build web 3 apps as easy as cloud apps.

Token Overview

As mentioned above, the Stacks Blockchain utilizes Stacks tokens (STX) to facilitate the majority of actions within the ecosystem. Within the next year, STX tokens can be used to:

Register Digital Assets: STX is burned when a user registers a blockchain-based username, domain, or digital asset.

Fuel Smart Contracts: STX is used to publish Clarity Smart Contracts and execute functions on these contracts.

Pay for Transactions: STX is used to process transactions on the network. These fees are distributed to the miners who verified the transactions through Tunable Proofs.

Block Rewards: Through an adaptive burn and mint mechanism, STX is paid out to hardware miners in the form of block rewards for securing the network.

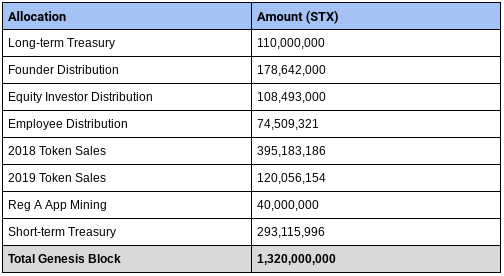

Token Distribution

The Blockstack token distribution currently has a wide array of different allocations for a range of participants in the Blockstack network. For the most part, this is one of the more detailed token distributions we’ve come across. However, there are some slight concerns when looking at the “big picture” of the initial token allocation. The genesis block generated 1.32B STX tokens in total. Of the 1.32B STX tokens minted, 1.16B STX (87%) will largely be distributed to the founders, the team, and the private investors. Other smaller allocations will be used to incentivize participation in the network, such as application mining (more on this later). The majority of the initial allocation will be distributed periodically over the next three years, subjecting STX to a fairly high issuance rate in the short-to-medium term.

Stack tokens that were sold through a token sale are generally subject to two different types of vesting periods, a transfer lock and a time lock. Transfer locks are used when the token sold is classified as “restricted securities” under the Securities Act of 1933.

With this, STX tokens subject to transfer lock are non-transferable for 1-year following the close of the sale. On the other hand, time locks are simply a general restriction preventing the tokens from being used in any capacity on the network where the tokens will be released evenly on a pre-defined period of time (generally 2-3 years).

Graph via Binance Research

Tokens sold or distributed from the Founder’s Distribution, the Equity Investor Distribution and the Employee Distribution are all subject to a three-year time lock from the date of the genesis block.

Of the 802,374,713 STX tokens sold or distributed in the Founder’s Distribution, Equity Investor Distribution, 2018 Token Sales and 2019 Token Sales, approximately 99% of these tokens will be released from their time lock by the end of October 2021. With that in mind, the next few years of Stacks token distribution is set to undergo a moderate inflation rate as investor tokens continue to be released.

It is important to note that while only 1.32 billion STX tokens will be created at the Genesis Block, there is no pre-set limit on the number of Stacks tokens that will be released over time through mining. Once mining starts, new Stacks tokens will be released using an adaptive mint and burn mechanism. With this, the team estimates that by 2050, there will be no more than approximately 2.048 billion STX in circulation.

Adaptive Mint and Burn

The Adaptive Mint and Burn mechanism is a dynamic element with the Blockstack’s monetary policy. The mechanism looks at the activity in the network and the amount of STX tokens burned in order to determine the proper block rewards. Therefore, the goal of adaptive mint and burn mechanism is to release a minimum amount of STX per block during low network activity while increasing the number of minted tokens per block when there’s higher network activity. Here’s a look at how that might play out:

Table via Stacks Token Economics Whitepaper

Application Mining

Blockstack’s application mining is one of the more innovative things we’ve seen implemented in a token distribution. A current dilemma with decentralized businesses is the inability to create rent-seeking applications due to the nature of open-sourced software. In the past, previous dApps on other decentralized computing networks (i.e. Ethereum) have relied on token sales that promote the creation of unnecessary, application-specific tokens. With this, Blockstack launched the Reg A App Mining Program, which issues rewards in Bitcoin (BTC) and Stacks (STX) to developers of well-reviewed applications.

Similar to how traditional PoW mining rewards contributing computing power to secure the network, the Blockstack ecosystem rewards applications being built on the network. With application mining, developers can benefit from an entirely new mechanism for bootstrapping their application without relying on private equity. Instead, every month, qualifying applications compete for a portion of the allocation. Apps are reviewed by “expert app reviewers” who were initially elected by the Blockstack PBC.

For the 40,000,000 STX allocated towards the Reg A App mining program, the rewards pool starts at $100,000 payout in STX tokens in addition to the $100k in BTC. In 2019, total monthly payouts will begin to ramp up with the total monthly payout switching to entirely Stack tokens. Ultimately by May 2020, app mining will increase to $1,000,000 in total monthly payouts entirely in STX tokens.

All qualified applications can be found on https://app.co/ which features a myriad of Blockstack applications alongside popular Ethereum applications. Application mining as shown to be rather successful with major applications raising anywhere from $10-$25k per month along with Dmail reaching nearly $100,000 in total funding in the past few months. This is just the beginning. As of now, Blockstack is distributing around ~$200,000 every month for app mining rewards. As mentioned above, this will only continue to scale up over the course of the next 6-9 months.

Blockstack Network Metrics (Apps and Registered Domains)

Blockstack has already garnered over 250+ applications on the network in the short time it’s been live. According to Binance Research, GraphiteDocs is the application with the most downloads, just reaching over 10,000 within the past few months. While Graphite is the leading application, all Blockstack apps are beginning to show signs of growth. It will be interesting to see how App Mining affects the quality of applications in the future, and in turn, the amount of activity any of these apps receive as funding continues to increase.

Graph via Binance Research

In addition to app downloads, Blockstack registered IDs is another core metric that’s vital to understanding the overall health of the network. Luckily, there’s been a fairly substantial uptick in total addresses within the past few months. As of writing, there are currently 155,669 identities registered on Blockstack. We can assume that this metric will only increase as STX tokens begin to leave the hands of private investors and start circulating the broader crypto market. Once the STX tokens see a wider distribution to a bigger audience, it only makes sense that a percentage of this will be permanently burned as users register domain names and other addresses to interact with emerging applications.

It is important to note that while registering digital assets (i.e. identities) on the Stacks blockchain requires the burning of STX tokens as fuel, Blockstack PBC is currently covering the service to pay for identities on behalf of users. Through this service, anyone can get a free identity from Blockstack in the id.blockstack namespace today. As a result, it can be assumed that a fair share of the 155k+ addresses currently registered did not require the burning of STX tokens.

Graph via Binance Research

In terms of new smart contracting platforms, Blockstack has likely garnered the most substantial amount of traction among developers with its unique implementation of application mining on the network. As such, app mining provides a robust incentive mechanism for developers to build new and exciting applications on Blockstack’s computing infrastructure. As we mentioned above, this is something that we’ll continue to watch closely as the App Mining reward pool scales to $1M per month.

Despite the intriguing amount of adoption from the Blockstack network and some innovative mechanisms, the first few years will likely be an uphill battle in terms of price discovery. With nearly a billion tokens coming onto the market from multi-year investor lock-ups, it’s going to be tough to combat that sell-side pressure with buyer demand. Moreover, given that Blockstack filed for the Reg A offering, they will be restricted from listing on US exchanges in the foreseeable future. We can expect that the lack of exposure from US retail investors will bring some issues in terms of liquidity and price discovery.

Drawbacks & Concerns

Outside of the concerns with the token distribution listed above, the largest drawback for Blockstack is competition. While Blockstack has demonstrated a strong ability to execute and attract development talent, it’s largely agreed that Ethereum is currently the market leader when it comes to decentralized application development.

This is not to say that there can only be one clear winner in the greater blockchain ecosystem, but it is safe to assume that the “winner” will likely captures the lion’s share of aggregate value in the coming years. With this in mind, the success of STX token is entirely reliant on the assumption that developers see Blockstack as a more suitable base layer solution than Ethereum (or any other native blockchain).

Lastly, while Blockstack’s funding rounds are definitely worth praising on the legal side of things, STX sale valuations are likely to be a large inhibitor of future token appreciation. Based off published figures, it’s clear that many of Blockstack’s earliest investors could enjoy upwards of a 100%+ returns relative to the prices STX were sold to Reg A+ investors.

Compared to traditional equity structures where private investors were largely limited to public offerings to liquidate their holdings, Blockstack’s future listing on Binance provides a unique opportunity for early investors to enjoy liquidity far sooner than what they are used to in traditional markets.

We at Fitzner Blockchain expect that the STX token may struggle to hold its value until the ecosystem is fully functional with clear demand from end-users (rather than developers capitalizing off app mining) and the majority of private tokens have vested to lift the continuous sell-side pressure.

Conclusion

When it comes to the growth of the blockchain ecosystem as a whole, we believe that Blockstack is a crucial player in providing legal clarity on how to navigate tokenized fundraising in the United States. As such, Blockstack could garner increasing demand in the coming years as the value behind decentralized applications becomes more apparent.

With Reg A+ tokens set to be distributed before the end of the year, it’s likely that Blockstack will be receiving a good amount of press in the coming weeks. We want to take this time to tell our readers to be weary of volatility due to some of the figures illustrated above. While we do see a significant opportunity for Blockstack to capture a majority of the dApp market, it’s likely that this growth will play out in the next few years with the launch of crucial features that make the ecosystem more readily accessible to average users.

In the meantime, we will definitely be keeping a close eye on the project. There’s no denying that programs such as application mining are an intuitive step towards incentivizing the sheer volume of products that have a chance at making it mainstream. Until then, we’re hopeful that 2020 will provide clear signals as to which existing layer one solutions (including Blockstack) have a bright future.