When it comes to cryptocurrency exchanges, many have been quick to recognize Binance as one of the leading platforms to trade the most popular digital assets on the market. As one of the few exchanges that constantly ranks in the top 5 on Messari’s Real 10 Exchange Volume, it’s no surprise that many traders have come to see Binance as the defacto platform for storing and trading their digital assets.

Binance’s native token, BNB, has implemented multiple use-cases to drive value back into the token through the usage platform (described below).

For those unaware of recent legal developments, Binance announced that this September, they would be preventing US participants from registering on its main site, binance.com. While this news resulted in BNB taking a hit (along with most of the market), it’s worth noting that Binance US is currently available for all American citizens to take advantage of.

In this post, we’ll be taking a look at why we believe BNB is still a leading contender in the realm of exchange tokens and why token holders could see a strong upside during the next bull market.

Background

Binance released its whitepaper in June 2017, outlining an ambitious goal to build a world-class digital asset exchange. The project successfully raised $15M in July of 2017 with BNB set at a base conversion rate of $0.10 per token (1 ETH = 2700 BNB).

The Binance team is led by prominent crypto community member, Changpeng “CZ” Zhao. CZ has years of experience working on exchange products before starting Binance in early 2017. By leveraging his fintech experience building white-label exchange systems, CZ and his team were able to create one of the most innovative and profitable companies in the blockchain industry today.

Token Overview

As mentioned above, Binance has gradually developed several different use-cases to encourage more users to acquire BNB. While many of these have changed over time, let’s take a look at some of the most notable use-cases that are present today.

Trading Discounts

First and foremost, BNB can be used to cover maker and taker fees when trading on a Binance exchange. As it was originally designed in the whitepaper, holding BNB in your account entitles you to the following discounts:

In July, Binance announced that they will retain the 25% trading fee discount for traders using Binance Coin (BNB) for at least one more year. From 2019/07/14 00:00:00 AM (UTC) to 2020/07/13 23:59:59 (UTC), the trading fee discount will remain at 25%, instead of the previous decrease to 12.5% as stated in their whitepaper.

Staking Benefits

For those unfamiliar with the Initial Exchange Offerings (IEOs), Binance was at the forefront of a revived utility token fundraising mechanism that gained traction throughout 2019. In short, rather than a team conducting an Initial Coin Offering (ICO) and then listing on a reputable exchange, IEOs takes the entire process in-house. Historically, Binance IEOs have offered more advantageous deal structures than ICOs in the form of lower hard caps and purchasing limits to further democratize the capital pool.

Lottery Tickets

Binance’s Lottery System determines IEO eligibility based on the amount of BNB held in any given wallet throughout a predefined window of time. It’s important to note that the larger your BNB holdings, the more lottery tickets you will receive. This does not guarantee access but rather increases the chances that you will be able to participate in the sale (in rare cases more than one time). Similarly, the amount of BNB required to receive a lottery ticket along with the number of lottery tickets earned is changed on a case-by-case basis. Here’s an example of how this looks in practice:

Community Voting

For those unfamiliar with the concept of community voting, it was once common practice for exchanges to list anywhere from 5-10 tokens to compete in a monthly poll for exchange listings. Once it became clear that many of the projects up for listing were incentivizing participation with bounty campaigns, the majority of exchanges abandoned this strategy altogether.

However, Binance recently picked up community voting again with a new spin. Rather than having voting be tied to one vote per account, the new system ties token ownership to voting weight. Similar to the layout for the Lottery tickets, the more BNB you hold, the more votes you receive. Furthermore, there are only two coins competing against one another, rather than a slew of projects with little to no attention.

Generally speaking, the thought here is that this system makes it much easier to distinguish if whales (otherwise known as traders with large BNB holdings) would be interested in trading a specific proposed token. Similarly, strong supporters of a given project would be likely to go out of their way to accumulate more BNB seeing as the voting is no longer equal across the board. While the ethics behind this schema may be debated, this method of community voting will likely inquire a strong demand for BNB than previous methods.

DEX Transactions

This past year marked the launch of Binance Chain, a native chain in which BNB is used to process all transactions on the network. This was largely due to the development of a native decentralized exchange (DEX) which saw many stagnant ERC or NEP tokens migrating to the BEP standard in the hopes of capturing more trading volume. Binance continues to influence the use of the DEX by signaling that projects with *significant* volume on the DEX has a strong chance of being listed on the main site. It only seems logical as those with the most volume on the DEX are also generating the most income to Binance in the form of BNB transaction fees.

Token Distribution

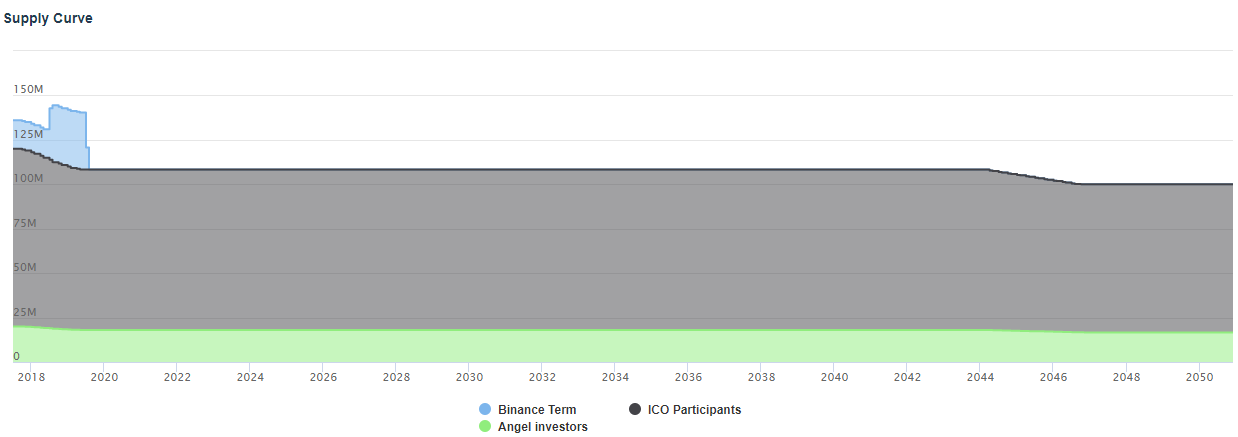

200,000,000 BNB was minted at the origin in July 2017. As outlined in the background section, the three major Binance Coin allocations are the angel investors, the founders, and the ICO participants.

The founders will receive 80 million BNB (40% of total supply) vested over four years where half of the allocation is vested immediately. The founder’s vesting schedule will run until 2021.

Angel investors will receive 20 million BNB (10% of total supply) with the entire allocation vested immediately.

Lastly, ICO participants were allocated 100 million BNB (50% of the supply) in the public sale where the majority of public investors did not have a vesting schedule. However, it is entirely possible that any crypto funds involved in a “pre-sale” could have been subject to vesting terms.

Graph via Messari

BNB Burning Events

Rather than relying on a programmatic monetary policy to drive scarcity (like Bitcoin), Binance is taking matters into their own hands. As originally outlined in the whitepaper, the company is scheduled to burn BNB every quarter based on the amount of total trading volume over the past 90 days.

Table via Binance Academy

On average, Binance has burned 0.78% (1,557,906 BNB) of the total supply per quarter. If this held true for the remainder of the burning events moving forward, Binance will hit its 100M BNB burning allocation between July and October of 2033. If we took the median rate, Binance burns at a slightly higher rate of 0.82% (1,633,902 BNB) per quarter. With this in mind, if the company was able to maintain the median rate in perpetuity, the 100M BNB burning threshold will be reached between October 2032 and January 2033.

Taking a more conservative approach, let’s assume that Binance will on average burn 0.25% of the total token supply per quarter, resulting in 500,000 BNB burned every 3 months. With this, Binance would reach the burning threshold by April 2063.

Lastly, let’s assume that Binance on average burns BNB at its most recent rate of 0.40%. At this rate, every quarter 808,888 BNB will be burned, allowing Binance to reach the burn threshold between July and October of 2046.

It’s important to note that these rates are calculated based off an extremely small dataset (i.e. 8 burning events) and will likely not represent Binance’s future burn rate. The calculations outlined in this Token Tuesday are to give our readers a better grasp about future BNB burning events and how long it will take for Binance Coin to hit its minimum total supply.

Seeing as the BNB being burned is coming from the team internal reserve, these events do not have a direct correlation on price as if they were purchased off teh open market. With this being said, burn events can still be seen as a long-term value driver behind Binance Coin as scarcity plays an increased role as time goes on.

If you’re interested in seeing how we calculated these numbers, feel free to visit our spreadsheet here.

Concerns

As it currently stands, BinanceUS is seeing very low daily volumes. Whether it is the fact that there are few assets, trading pairs or lacking features such as Launchpad on the platform, it’s no surprise that BNB has had a rough past few months.

In our minds, this could largely be due to the friction and downsides added with mandatory KYC. Generally speaking, Binance was the best exchange, especially for US investors, to quickly onboard into the world of altcoins as sign-ups only required an email. With BinanceUS now mandating KYC for sign-ups in parallel with the lack of altcoins and other features, US investors have little incentive to move away from other major US exchanges, such as Coinbase.

Furthermore, Binance’s recent change from a mandated BNB burn using 25% of the company’s profits have been substituted with a far more ambiguous “we will destroy BNB based on the trading volume”. The lack of transparency surrounding the burn events makes it very difficult for traders to know how much BNB will be burned, or how much Binance had made in profit on any given quarter.

The last potential concern surrounding Binance is identifying the advantages that Binance Chain offers over other rising smart contract platforms, like Ethereum.

Ultimately, it would be no surprise that the demand for BNB will likely only increase with demand for altcoin trading as a whole. A trend that has yet to be seen in 2019.

Conclusion

When taking into consideration both sides, we still believe that Binance offers one of the strongest centralized trading solutions when it comes to digital assets. With the implementation of fiat on-ramps, margin trading and numerous staking services, there’s no doubt that Binance continues to be the frontrunner for retail trader engagement.

With the numerous utility mechanisms associated with BNB in tandem with the quarterly burns, we believe BNB has one of the strongest token economies than virtually all other exchange tokens currently on the market.

We suspect that BNB can capture a significant amount of traction and volume during the next bull run. It’s likely that following a strong run-up by top assets such as Bitcoin and Ether (ETH), many smaller assets will follow, most of which will likely have the large majority of their trading volume taking place on Binance. To state it simply, when retail demand for digital assets increases, we expect the price of BNB to rise as well.

*DISCLOSURE: The managing partners do not endorse or recommend any investment action in BNB. This document should not be regarded as investment advice, offering document, or as a recommendation regarding a course of action. The managing partners of Fitzner Blockchain own BNB. These views are those solely of the managing partners of Fitzner Blockchain Consulting and do not represent the views of the Binance team.